NVIDIA Stock (NVDA) Research Report: 2026 Growth Outlook, Rubin Architecture & Sovereign AI Analysis

Executive Summary: The Era of Industrial AI

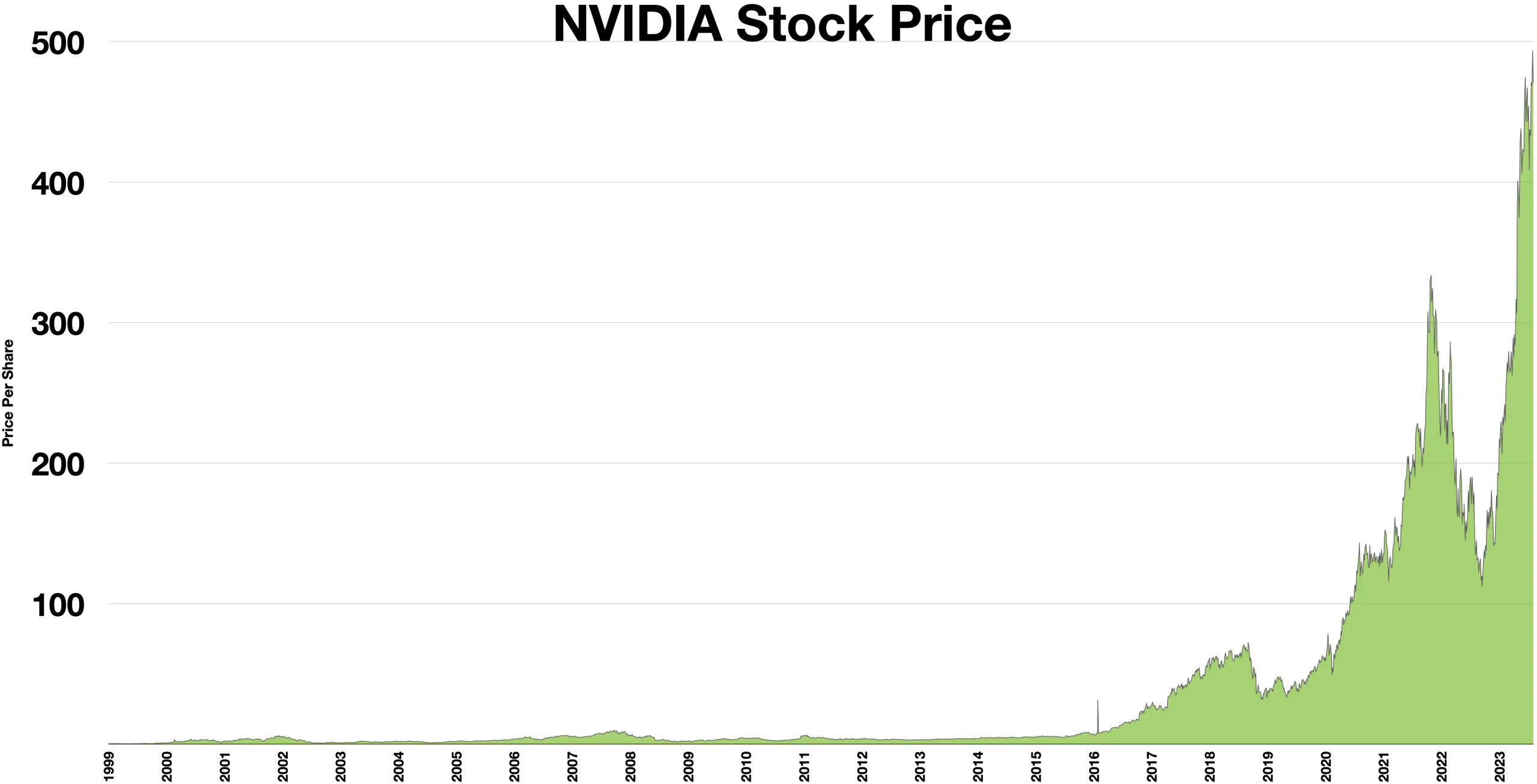

As of January 25, 2026, NVIDIA Corporation (NASDAQ: NVDA) continues to redefine the technological landscape, trading near $186 with a market capitalization of approximately $4.6 trillion. Having surpassed previous milestones to rival Apple and Microsoft for the title of the world’s most valuable company, NVIDIA has transitioned from a hardware component manufacturer to the “foundry” of the AI economy.

The investment thesis for 2026 has shifted from simple data center expansion to three critical growth pillars: Sovereign AI (nations building domestic infrastructure), Physical AI (humanoid robotics), and the architectural leap to Rubin. With Fiscal Year 2025 revenue hitting a record $130.5 billion (+114% YoY), NVIDIA is not just selling chips; it is selling the intelligence grid for the next industrial revolution.

Financial Performance & Market Valuation

NVIDIA’s financial dominance remains unchallenged, driven by insatiable demand for the Blackwell platform. The company’s “moat” is evidenced by its ability to maintain gross margins in the 73-75% range, a figure unheard of for hardware hardware-centric businesses.

| Metric | Q4 FY2025 (Reported) | FY2025 Total | FY2026 Projection (Consensus) |

|---|---|---|---|

| Revenue | $39.3 Billion (+78% YoY) | $130.5 Billion | $200 – $212 Billion |

| Data Center Rev. | $35.6 Billion | $115.2 Billion | $180 Billion+ |

| Gross Margin | 73.6% | 73.4% | ~74% |

The Blackwell Supercycle

The Blackwell B200 and GB200 NVL72 systems have seen the “fastest product ramp in history,” generating $11 billion in revenue in Q4 alone. Despite a backlog of 3.6 million units, NVIDIA has successfully mitigated early supply chain bottlenecks by expanding CoWoS-L packaging capacity with TSMC. The shift from training to inference is a major tailwind, as Blackwell offers a 25x efficiency gain for inference workloads, making “reasoning” models economically viable.

Roadmap Deep Dive: From Blackwell to Rubin

NVIDIA’s “one-year rhythm” strategy is aggressively widening the gap against competitors like AMD and Intel. The focus now turns to the Rubin Architecture, slated for late 2026/2027.

- Rubin (R100/CPX): Confirmed to utilize the 3nm process node and next-generation HBM4 memory.

- Memory Supremacy: Rubin GPUs will feature up to 288GB of HBM4, delivering a staggering 13 TB/s bandwidth. This is critical for “Agentic AI” models that require massive context windows.

- Rubin CPX: A specialized processor designed for massive-context inference, enabling million-token processing for coding and generative video applications.

Strategic Growth Pillars: Sovereign & Physical AI

To sustain growth beyond hyperscaler capex, NVIDIA has cultivated two massive new markets.

1. Sovereign AI: Nations as Customers

Governments are treating AI infrastructure as a strategic asset akin to energy or defense. NVIDIA’s direct partnerships with nation-states bypass traditional cloud providers, reducing customer concentration risk.

“AI, like electricity and the internet, is essential infrastructure for every nation.” — Jensen Huang, Jan 2026

Key Developments:

- Saudi Arabia (Project HUMAIN): A landmark partnership to build 18,000 Grace Blackwell supercomputers, aiming to deploy 500MW of AI capacity.

- UAE & Europe: Similar “AI Factory” initiatives are underway with Mistral AI in France and the Technology Innovation Institute (TII) in Abu Dhabi.

2. Physical AI: The Robotics Revolution

At CES 2026, NVIDIA unveiled significant updates to Project GR00T, a foundation model for humanoid robots. This sector is moving from R&D to commercial pilots.

- Jetson Thor: A new robotics computer powered by the Blackwell architecture, designed specifically to run complex transformer models locally on humanoid robots.

- Ecosystem Adoption: Major players like Boston Dynamics, Neura Robotics, and LG Electronics have integrated the NVIDIA robotics stack.

Risks & Investment Considerations

While the outlook is bullish, investors must weigh specific risks:

- Antitrust Scrutiny: Ongoing investigations in the EU, US, and China regarding software lock-in (CUDA) and bundling practices.

- Geopolitical Volatility: Export controls to China remain a fluid situation, though NVIDIA has successfully pivoted with compliance-focused chips.

- Competition: While AMD’s MI325X and internal silicon (Google Axion, AWS Trainium) exist, NVIDIA holds 80-92% market share. The real threat is long-term “inference offload” to cheaper, specialized chips.

Future Outlook: 2026 Price Targets

Wall Street remains overwhelmingly positive. The consensus rating is a “Strong Buy” with price targets ranging from $200 to $352. The bull case assumes NVIDIA becomes the first $6 trillion company by 2027, driven by the successful launch of Rubin and the monetization of “Physical AI.”

Advanced Topical Map

The following entity structure represents the semantic ecosystem of NVIDIA’s dominance:

- Core Entity: NVIDIA Corporation (NVDA)

- Architecture:

- Current: Blackwell (B200, GB200 NVL72), CoWoS-L Packaging.

- Future (2026/27): Rubin (R100, CPX), HBM4 Memory, 3nm Process.

- Strategic Verticals:

- Sovereign AI: Project HUMAIN (Saudi Arabia), Sovereign Cloud.

- Physical AI: Project GR00T, Jetson Thor, Jetson T4000, Humanoid Robotics.

- Software Moat: CUDA, NIMs (Inference Microservices), NVIDIA AI Enterprise, Omniverse.

- Key Figures: Jensen Huang (CEO), Colette Kress (CFO).

- Architecture:

Sources & References

- •

NVIDIA Investor Relations Q4 FY2025 Earnings Report - •

CES 2026 Keynote by Jensen Huang - •

TrendForce HBM4 Memory Market Analysis - •

Project HUMAIN Announcement (Saudi Arabia/PIF)