Walmart Hits $1 Trillion Market Cap: The Historic Shift from Retailer to Tech Giant

Executive Insights

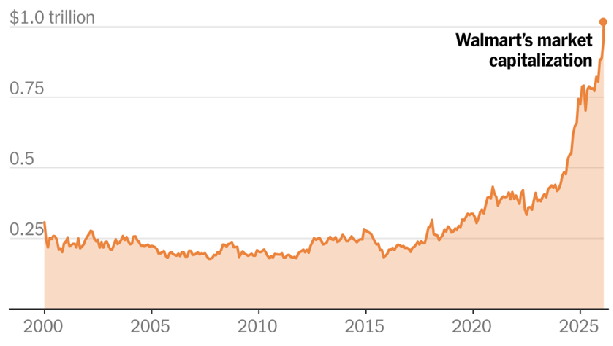

- Walmart crossed the $1 Trillion Market Cap threshold on Feb 3, 2026, becoming the first traditional retailer to do so.

- The company switched its listing to Nasdaq and joined the Nasdaq-100 Index in early 2026, cementing its status as a tech leader.

- New CEO John Furner took the helm on Feb 1, 2026, driving a strategy of ‘Adaptive Retail’.

- High-margin revenue from Walmart Connect (Ads) and Walmart+ memberships fueled the stock’s re-rating.

- Strategic partnerships with OpenAI and Symbotic have automated supply chains and revolutionized the customer shopping experience.

The Trillion-Dollar Milestone: A New Era Under John Furner

Trading closed yesterday with WMT shares priced above $126, cementing a valuation of $1.01 trillion. This historic achievement comes mere days after John Furner assumed the role of CEO on February 1, succeeding Doug McMillon. While McMillon laid the digital foundation, the market’s enthusiastic response to Furner’s leadership signals confidence in his aggressive “Adaptive Retail” strategy.

Walmart now stands alongside tech titans like Nvidia ($4.5T), Apple, and Microsoft. Crucially, it is the only member of this elite group whose roots are in brick-and-mortar retail, highlighting the success of its “click-and-mortar” hybrid model.

Market Context: Walmart’s inclusion in the Nasdaq-100 Index on January 20, 2026—after switching its listing from the NYSE to Nasdaq in December 2025—was a pivotal precursor, forcing a re-rating of the stock by algorithmic traders and passive tech funds.

Agentic Commerce: AI Beyond the Search Bar

The primary driver of Walmart’s valuation surge is its pivot to Agentic Commerce—a system where AI predicts and acts on customer needs rather than waiting for commands. Central to this is Sparky, the company’s GenAI shopping assistant.

The OpenAI Partnership

In October 2025, Walmart deepened its collaboration with OpenAI, allowing customers to shop directly through ChatGPT. Unlike traditional e-commerce, which relies on keyword search, this integration enables:

- Contextual Shopping: Users can upload a photo of a dinner party space, and Sparky generates a full list of decor and food items, checking local store inventory in real-time.

- Predictive Replenishment: AI analyzes consumption patterns to auto-fill carts with recurring essentials before the customer runs out.

- Hyper-Personalization: Dynamic Showroom features allow users to visualize furniture in their actual living rooms using AR and GenAI.

Supply Chain Singularity: The Symbotic Deal

Walmart’s operational efficiency has reached new heights through its strategic restructuring with Symbotic (NASDAQ: SYM). In January 2025, Walmart sold its internal “Advanced Systems and Robotics” unit to Symbotic, opting to outsource innovation to the specialist while retaining a massive equity stake.

| Initiative | Details | Impact |

|---|---|---|

| Symbotic Partnership | Deployment of AI-bots in 400+ Accelerated Pickup & Delivery (APD) centers. | Reduces fulfillment costs by ~20%; enables <1 hour delivery windows. |

| Drone Expansion | Partnership with Alphabet’s Wing Aviation expanded to 100+ stores. | Last-mile delivery for 95% of U.S. households. |

| Predictive Inventory | AI models forecasting demand at the granular store-aisle level. | drastically reduced out-of-stocks during the 2025 holiday season. |

The Profit Engine: Walmart Connect & Services

Wall Street has re-rated Walmart largely because its profit composition has shifted from low-margin retail goods to high-margin services.

Walmart Connect

The company’s retail media network, Walmart Connect, has grown into a $4 billion+ annual business with margins rivaling digital ad platforms. By leveraging first-party shopper data, Walmart offers advertisers closed-loop attribution that traditional TV or social media cannot match.

Walmart+ Membership

As of January 2026, Walmart+ boasts a record 28.4 million members. The recurring revenue from subscriptions, combined with the data gathered from these loyal shoppers, provides a defensive moat against Amazon Prime. The “In-Home Delivery” add-on has seen particularly high adoption among affluent demographics, a segment Walmart historically struggled to capture.

Financial Outlook: The Nasdaq-100 Effect

The decision to move to the Nasdaq was symbolic but carried tangible weight. It aligned Walmart with the volatility and growth multiples of the technology sector. Since the switch:

- P/E Expansion: Walmart now trades at ~42x forward earnings, a premium justified by its tech-enabled margin expansion.

- Institutional Flows: Inclusion in the Nasdaq-100 forced passive tech ETFs to buy billions in WMT stock, creating a structural tailwind for the price.

- Revenue Growth: Analysts project fiscal 2027 revenue to top $770 billion, driven by the “flywheel” of e-commerce (growing 22% YoY) and advertising.

Conclusion: The First of the “Adaptive” Giants

Walmart’s ascent to a $1 trillion market cap is not just a victory of scale, but of adaptation. By successfully grafting a high-tech nervous system onto a massive physical skeleton, Walmart has created a model that neither pure-play tech (Amazon) nor pure-play retail (Costco) can fully replicate. Under CEO John Furner, the company is no longer just selling goods; it is selling convenience, time, and anticipation—commodities that are proving to be worth over a trillion dollars.

In-Depth Q&A

Q: When did Walmart reach a $1 trillion market cap?

Walmart officially surpassed the $1 trillion market capitalization milestone on Tuesday, February 3, 2026, with its stock price closing above $126.

Q: Is Walmart now part of the Nasdaq-100 Index?

Yes. Walmart moved its listing from the NYSE to Nasdaq in December 2025 and officially joined the tech-heavy Nasdaq-100 Index on January 20, 2026, replacing AstraZeneca.

Q: Who is the current CEO of Walmart?

John Furner is the President and CEO of Walmart Inc. He assumed the role on February 1, 2026, succeeding long-time CEO Doug McMillon.

Q: What is Walmart’s ‘Sparky’?

Sparky is Walmart’s Generative AI-powered shopping assistant. It uses advanced natural language processing to help customers plan events, find items, and manage shopping lists through conversational interactions.

Q: How does Walmart use Symbotic technology?

Walmart uses Symbotic’s AI-enabled robotics platform to automate its supply chain. In January 2025, Walmart deepened this partnership by selling its internal robotics unit to Symbotic and committing to deploy automation in 400+ pickup and delivery centers.